Generation Y, those born between 1981 and 1995, have well and truly made their mark on the work force. This generation, with their finely honed degree's in Facebook, Twitter and Squiggle or whatever the next big thing is, have very much got their fingers on the pulse (or home button of their iPhone 15).

The first wave of Gen Y's are turning 34 this year (old buggers). A subset of this generation, between their gap years and secondments, have actually done some work and steadily built careers through continued learning, hard work and perseverance. Ingredients to success which are no different, mind you, from those required by any previous generation, except Gen Y's also know how to poke their enemies on Facebook.

With so many Gen Y's now climbing up the career ladder, we'd expect to see their share of private wealth grow to reflect this. Research from the Grattan institute has demonstrated that the opposite is happening and Gen Y’s share of private wealth is shrinking in both nominal and real terms (as shown in the below graph). This article skims the surface of this demographic issue and sticks to a 'tongue in cheek' approach to how Gen Y’s might curb this trend.

The blame for this declining share of wealth can't be placed wholly on Gen Y's spending priorities and we suspect this has as much to do with poor financial management as it does with a different set of present day opportunities.

In no other generation has the barrier to home ownership being so astronomically high. One of the biggest upsides in home ownership has nothing to do with property being some amazing investment and everything to do with the behavioural impact associated with home ownership, which forces you to allocate a much bigger chunk of your income towards mortgage repayments than rent. Owning a home is a tremendously effective way of re-prioritising shelter, required for your survival, over shopping binges or annual pilgrimages to Europe/Bali/Thailand (or whatever other vice that Gen Y's prioritise).

One of the most common sentiments I come across when working with Gen Y's is that although their income may have doubled or tripled since entering the workforce, their saving capacity has hardly changed at all. A Gen Y's bank account has become a very effective financial sieve – salary goes in and drains out seamlessly over the next month.

During the early stages of a career, increased spending in line with salary increases has little do with inflation and almost everything to do with behavioural priorities. When each member of this generation first entered the work force, they were likely on significantly lower incomes than what they receive now. If you step back and assess the quality of life you had in your first few years of your career, it would likely not differ dramatically from today.

It should be no secret that the biggest impact an individual in Gen Y (or Gen X) can have on their financial management, is through a change in spending habits. This can involve a self-directed budget for those with discipline or it might require some outside help for those whose enjoyment in life overrides their satisfaction in meeting their weekly budget target.

Real life example

Phoebe is a 28 year old social media wizz. She works for a large bank and her income has increased over the last seven years from $35k p.a. as a graduate, to a salary of $100k p.a. as a digital community manager. Phoebe’s 50 year old boss doesn't actually know what Phoebe does but when she says things like SEO, multi-platform communication and expanding digital footprint, he is convinced that Phoebe is good at her job. On top of all that, her manager is impressed by “the amount of followers the bank has amassed on the twitter, Facebook and squiggle (whatever that is)”.

Phoebe partied pretty hard in her early twenties and looks back with wonder at how she ever went out both nights of the week-end, paid rent and survived on $35k p.a. These days her income is much higher and because she no longer goes out both nights a weekend (because she is now so mature), she has been able to save a lot more money as well as having an awesome handbag collection to show for it. Even better, Phoebe is able to show off this collection on her annual girl’s trip to Europe, where she posts three pictures an hour to Instagram inspiring astronomically high levels of jealousy amongst any female who at that very moment was not personally wearing Jimmy Who’s while sipping half soy/skim piccolo’s on the Rue de Paris.

On top of a priceless amount of Instagram hysteria, Phoebe has actually managed to save almost $50,000 dollars which sits in a bank account accumulating interest. She thought about saving towards an apartment, but to buy an apartment where she is happy to live will cost around $700,000 in Sydney. This means that after a 20% deposit and 5% for costs (stamp duty and legal fees), Phoebe needs $175,000 to get into the market. With the property market seemingly rising faster than her ability to save, she has given up on the prospect of buying an apartment any time soon and is content to grow her @handbagsofeurope Instagram following.

What are Phoebe's options

Phoebe's current after tax income is about $6,254 per month. She spends a lot of this but is now able to save over $800 a month which she is impressed with. When Phoebe begun her career she was living off a comparatively small after tax income of about $2,688 per month. In the last six years Phoebe has become accustomed to spending an extra $2,700 per month!!

Let's propose a scenario where Phoebe exercises some self directed budgetary discipline and saves a further $1,500 per month above her current savings. Phoebe is still able to enjoy a lifestyle where she is outlaying $1,200 a month (or $300 a week after tax) more than when she started her career.

Let's take this scenario one step further and propose that Phoebe now engages a financial adviser to assist. The adviser sets up an automatic sweep of funds from her bank account after each monthly pay check. This sweep moves savings straight into an investment portfolio. Phoebe no longer has to think about how much to save each month as her adviser manages this on her behalf. Phoebe knows that if she spends everything remaining in her bank account after the sweep, she is still on track financially and on top of this she can check the status of her investment portfolio on the app she installed on her iPhone 16 (she recently upgraded). Even better, instead of Phoebe's saving's accumulating interest at less than 3%p.a., she utilises a more tax effective investment portfolio (due to some guy called Frank giving her credit) generating, on average, an 8% return per annum.

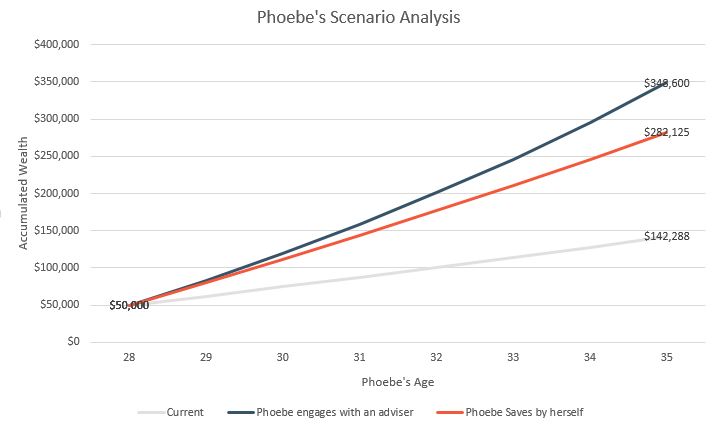

Projecting the above three scenarios (current, self directed saving and adviser engaged saving), we can demonstrate the net affect that this very realistic and manageable change has to Phoebe's circumstances. The below graph outlines the three scenarios we discuss and overwhelming demonstrates the importance of behavioural modification over a seven year period. Given that Phoebe's career is likely to continue to grow, the below modelling is actually a very modest projection of Phoebe's wealth accumulation potential.

Outcomes

Behavioural modification, resulting in a very manageable savings regimen, is the most significant contributor to Phoebe's improved financial circumstances;

When sticking to her self directed savings plan, within seven years Phoebe doubled the wealth she would have otherwise generated;

With the additional investment assistance of an adviser, Phoebe achieves this doubling of wealth within five years;

There is a negative correlation between Phoebe's wealth and the number people following Phoebe's @handbagsofeurope Instagram account.

When you are young and haven't yet generated a reasonable asset base, how well you save is far more important than how well you invest. It is only as you begin to accumulate scale in your assets, that your investment decisions become progressively more important.

If you are a disciplined saver then you are, or should be, on track to make the best of your circumstances. If you are not disciplined then the longer you wait to take action, the more difficult your wealth accumulation journey becomes.

Our savvy investor Phoebe was so impressed with the impact that her adjustment in lifestyle had in such a short space of time that she decided to sell all but a couple of her favourite handbags, funding a small holiday with friends. Coincidently, around this time Phoebe met a nice chap called Daniel (who as a keen cyclist, had a large collection of bicycles). Daniel was very impressed with Phoebe's 'down to earth' attitude and financial acumen that he was inspired to take similar steps to that of Phoebe. Within a short space of time they were able to pool their assets and bought an apartment together much sooner than either thought was possible. Fast forward a few years and Phoebe still has a favourite handbag and Daniel still has a favourite bike, but blimey, kids are expensive.