When the GFC hit in late 2007 the drug of choice to dull the the effects of the economic downturn was extensive government spending, often funded via debt issuing's. Since then, for both political and economic reasons, many global economies have been incapable of shaking their debt financed spending addictions. This has lead to an extraordinary growth in debt levels amongst most major economies, with global debt rising by $57 trillion between the end of 2007 and middle of 2014. About a third of this rise in debt was the result of governments borrowing to finance spending. Before we discuss the impact that this meteoric rise in government debt has on investors, it is worth considering why we are less concerned about private debt and more concerned about public (government) debt.

Private vs Public Debt

There is a very big difference between public and private debt. Private debt, like you or I taking on debt to launch a business or buy a house, is secured against us or our business. It is in the interest of debt issuers (typically banks), to assess both the entities capacity to repay private debt as well as what recourse the lender has to reclaim loan capital if this doesn't occur. I.e. debt issuers (like banks) will sell your house or liquidate business assets to extinguish loan obligations if necessary. As market forces govern access to private debt, they are empowered to self regulate their lending exposures, albeit within an overarching prudential regulatory framework (which the sub-prime mortgage crisis demonstrated had serious flaws in the US).

Most economists will agree that private debt is good (within reason). It is good in the sense that the issuing of private debt represents a reallocation of resources to an entity which believes it can generate value above the cost (interest) of debt repayments. This value generates an economic benefit which drives overall economic growth. As markets regulate lending exposures, it is in the best interest of the debt issuer to lend to the entity most likely to generate economic value, as this represents the safest loan. Private debt is effective at doing this and as all private debt has limited recourse to the entity acting as counter-party, excessive private debt is of a less direct concern to external stakeholders.

Public debt is a different animal. It is issued by governments and is not subject to market forces or its own set of prudential standards. Public debt is guaranteed by future government revenue streams (our collective tax payments) and the understanding that, if 'push comes to shove', governments can simply print more money. It's hard to get a safer loan than that, thus government bond issues are the low watermark for the cost of capital (interest).

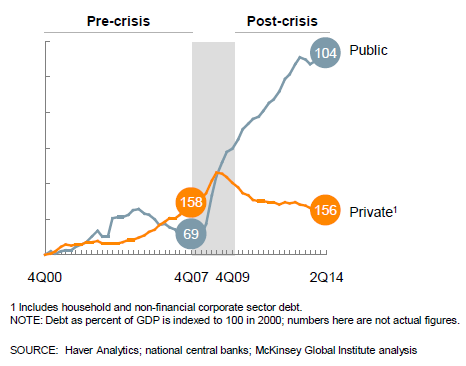

Governments are not subject to the same prudential standards that they enforce on private lending. This means there are no safeguards against the viability of public debt raising decisions. Even supposed government safeguards, like 'debt ceilings', have proved to be little more than a talking point for journalists. As the level of public debt continues to increase, the cost of servicing this debt (simply paying ongoing interest expenses) begins to constrain the effectiveness of both monetary and fiscal policy in addressing macro-economic themes. This continued rise in government debt post GFC, is clearly demonstrated in the below graph.

Numbers in this graph are reflective of debt as a percentage of GDP. X-Axis is time since 2000. Greyed area represents period of global financial crisis.

How does government debt effect the investor?

Government debt is now so high that servicing interest on existing debt is constraining a governments ability to make alternate fiscal policy spending decisions. In the US, 15% of all government spending goes towards servicing interest payments on existing debt obligations. Such a large debt burden is now impeding monetary policy decisions. Monetary policy, which controls interest rates, has to take into consideration the impact that a changes in interest rates has on government debt serviceability.

Lets consider the US as an example, Inflation is near zero in the US with unemployment steadily declining towards full employment. A high level of employment generates wage pressure which, when energy prices in the US stabilise, will generate inflationary pressure in the medium term. What will be interesting for global participants is how the Federal Reserve addresses rising inflation concerns.

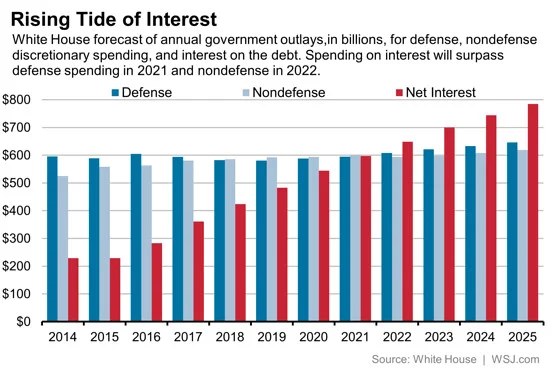

Typically, The Fed would raise interest rates to curb inflationary pressures. However, a raise in interest rates also increases the cost of servicing US public debt. Any increase in US interest rates will have a huge impact on servicing the US government's $18 trillion of outstanding debt. The annual interest expense on outstanding debt is already growing at an alarming rate due to the US's sustained budget deficits. Just meeting interest repayments on debt obligations is set to become the biggest US government discretionary spending obligation by 2022 (as seen in the below graph).

(nondefense discretionary spending is essentially every other domestic and international government program funded annually through congressional appropriations (excluding welfare and medicare which are not a discretionary spending decision)

With the US government debt burden at its current level and with consideration to its trajectory, The Fed's ability to raise interest rates has diminished out of fear of further exacerbating government budgetary pressure. Unless US government debt is addressed, subdued interest rates could remain a long term feature of the US economic environment. A similar case is playing out in many other countries around the world. We have focussed on the US by example given its position as a safe haven currency and driver of economic themes.

Where does this leave the investor?

If central banks of countries with large government debt bills are forced to keep interest rates low, then even healthier economies, without a government debt drag, will be unwilling to increase their rates for fear of eroding currency competitiveness. This pervasive low rate environment has created a squeeze on fixed interest investment opportunities, forcing many investors to search for yield much higher up the risk curve. This search for yield sees many risk adverse investors moving capital into more volatile asset classes. This continued search for yield has underpinned a long run on equity markets, even in the face of subdued underlying profit growth, where all typical metrics now indicate that markets are fully priced in both the US and Australia. This flow of capital into equities has being mirrored in the property sector, which has displayed sustained strong growth. (We touched on the predicament that the RBA faces when addressing economic and property concerns in a previous article on the 6th of April 2015).

How, if and when investment markets come off their yield hunt is unknown. Given the persistence of public debt, we may have stumbled into a sustained period of 'new technical norms' in measuring equities and property value. This would reflect a less than temporary move by investors higher up the risk curve, reinforcing the likelihood that high government debt is keeping interest rates subdued in the medium to long term.

One interesting development in response to this low yield environment has come from the Swiss. Those crazy chocolate, cheese and watch loving bankers have recently issued bonds at negative rates. You can now buy a Swiss bond that will upon its term give you back less money!! This shows you the premium that some market participants are placing on capital stability, questioning the sustainability of fully priced markets (although also reflecting future Swiss currency trajectories).

For those investors looking for capital stability alternatives, infrastructure has emerged as the latest poster child of investment asset classes. Infrastructure investments provide investors lower volatility income streams which can weather cyclical trends, whilst still providing a reasonable yield. Even this asset class is becoming subject to inflated valuation multiples with record levels of capital inflows.

As an investor, you now need to weigh up the opportunity cost of maintaining low yielding fixed income exposures against a potentially very volatile equities market in the short to medium term. How the investor approaches this capital allocation decision will reflect their view on whether they believe markets are adjusting to a sustained low yield interest rate environment, normalising previously inflated technical measures of valuation in equity and property markets. As with any capital allocation decision, irrespective of the economic analysis undertaken, the lesson for investors is always the same; diversify your risk and invest appropriately for your time horizon.