We met with the Australian based Fixed Income Investment Group (FIIG) last month and discussed how investors can adapt to financial markets continued squeeze on yield.

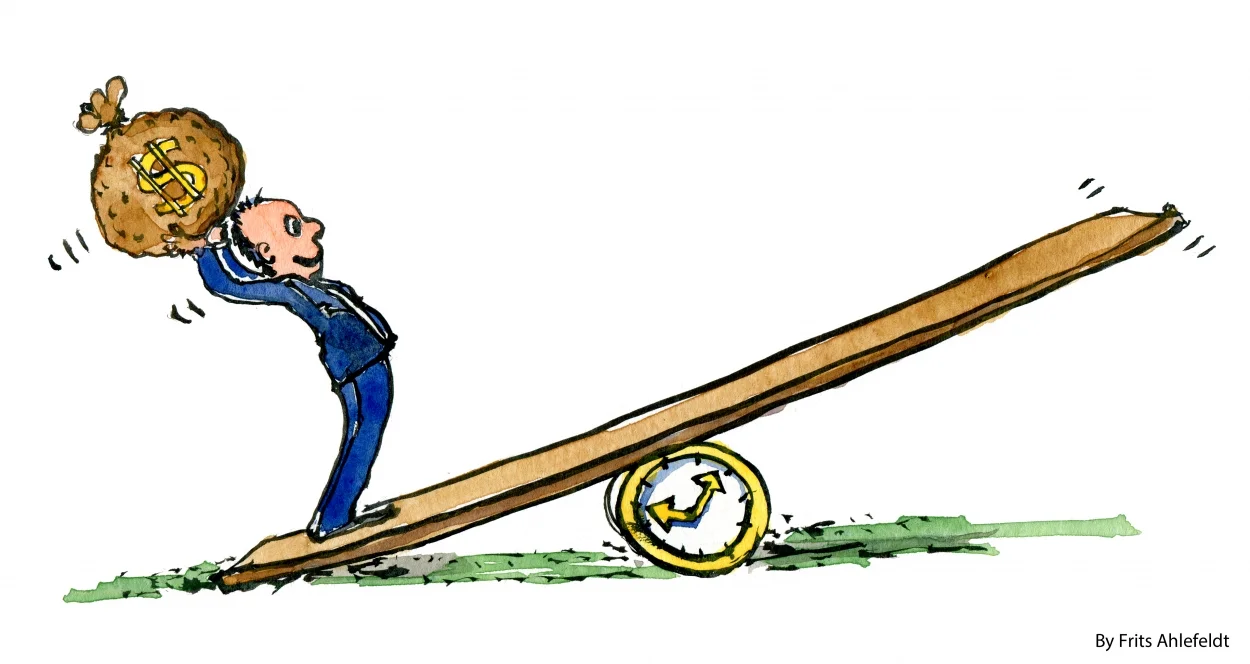

In the current low yielding investment environment, smart investors can still boost their returns by taking on carefully selected risk as part of a diversified portfolio.

Three ways that an investor can take on higher risk are by:

- Agreeing to part with their money for longer.

- Accepting weaker rights over the issuer’s assets.

- Investing in companies that are more at risk of failure (taking on credit risk).

Option 1

The first of these ways, longer terms until maturity, is something that most people will be familiar with from term deposits. These usually pay a progressively higher interest rate as the term increases. A few years ago, this simple strategy was good enough to generate a high medium term return. For instance, Westpac investors were paid an 8% fixed rate return for handing funds over for five years.

Unfortunately, it is not that easy any more with the incremental increase in return for committing to a longer dated term deposit now marginal. A good major bank term deposit rate for one year is around 2.7%, while the five year rate is 3.1%.

Bonds, the ugly brother of term deposits (or so it seems to appear for retail investors as it is largely ignored) is still rewarding investors for extending maturity dates. For example the Dampier to Bunbury Natural Gas Pipeline (DBNGP) joint venture has a bond maturing in September 2015 with a yield to maturity of 2.79% and another bond maturing in five years in October 2019 with a yield to maturity of 4.01%. The extra yield of 1.22% is compensation for investment in the same company over the longer term given there is less certainty about the performance of the company. Longer time frame bond positions mean that there is a greater chance of negative or poor operating conditions impacting interest repayment feasibility, whereas the closer we get to maturity, the more certainty there is for investors.

Option 2

The second way to get higher returns is by investing in securities lower in the company capital structure, which exposes you to more risk in the event that it fails. Each bank and company has a capital structure which shows the priority of payments in the event of a wind-up. Investments at the top of the ladder are repaid first (like senior and secured debt), while those at the bottom (equity holders) take on the losses first and are most likely wiped out.

Moving capital lower down the capital hierarchy has been a popular option, with investors swapping major bank term deposits for their shares, delivering enhanced returns over the last few years. With company valuations now at very high technical measurements, investors should consider capital structure allocations in the middle rungs, like corporate bonds, which can provide higher yields than cash exposures without the excess capital volatility of equity positions.

Option 3

The third way to boost returns is to replace investments in low risk companies for companies that are higher risk. Across bond, hybrid and share markets investing in higher risk companies should deliver higher returns. This can mean shuffling capital allocations from large cap to small cap stocks for equity holders. Or for those taking on bond exposures, you can explore companies that are not yet rated by credit rating agencies, or rated sub investment grade. Investors can earn much higher returns of over 6.0% but take on higher risk of default or non payment by the company.

A word of caution, returns are directly correlated to risk. The higher the risk, the higher the return should be. It’s very important that you understand what the risks are and make a judgement of the incremental return you need over the lower risk options to be compensated.

Special thanks to Elizabeth Moran of FIIG for research, writing and content development.