Economic Summary

- Volatility. BREXIT | Hung-parliament | Trump | QE unwinding | Record low interest rates

- We enter uncharted territory should de-globalisation increase in developed economies. Markets have little experience pricing current geopolitical uncertainties such as the “Trump Risk”. Protectionist and closed-minded political ideologies continue to gain momentum in emerging right wing parties. Australia is no exception.

- The Australian Government 10-Year Bond Yield dropped to a record low of 1.970% on 23 June 2016. Interest rates are lower for longer.

- Cash rate manipulation can no longer be the answer to our economic problems. We need fiscal (i.e. government policy) to drive economic reform and initiatives.

- Fiscal policy reform will be greatly impeded due to Australia’s hung parliament.

- Stimulus packages are expected from the UK and EU.

- The US may further delay raising interest rates in the wake of uncertainty.

- The Australian manufacturing sector has recorded its longest unbroken run of expansion in a decade, spurred by a weaker Australian dollar.

Brexit Special

Boris makes a real hash of it...

Divorces are traumatic and expensive; this was shaping up to be no exception as the immediate reaction showed:

- US$2.4 trillion was wiped from global equity markets

- GB loses £90b in a single day, ironically this is 10x the annual value of net payments made by the UK to the EU

- Unfortunately for the Brits, £90b isn’t worth nearly as much as it once was - the pound plummeted against all world currencies, losing more against the USD in a single day than any other time in history

- GBP/USD rate reached its lowest value since 1985

By these immediate economic and financial measures, the UK appears to have ‘shot itself in the foot’. However, as I am writing this, global markets are nearly back to their pre-Brexit levels and it looks as if the GB market is also recovering. On the plus side for the UK a low pound makes them more internationally competitive.

BREXIT Consequences

- Economists such as those at Credit Suisse, Goldman Sachs and HSBC predict the UK will fall into a recession, downgrading 2017 GDP forecasts from over 2% down to -1%

- Scotland may re-initiate a move to independence.

- Northern Ireland may subsequently follow Scotland’s lead.

- Could Ireland unite? – Would their combined football team be a force to reckon with?

Hamish Douglass, Magellan Funds Group CEO, outlines the following economic scenarios:

- 25% chance that the UK do not leave the EU

- 50% chance the UK leaves the EU with a carbon-copy of the current arrangements and restrictions levied on current non-EU member countries in exchange for participating in the EU trade zone.

- 25% chance UK leaves the EU, maintaining ‘greater control’ in exchange for more stringent trade sanctions

i.e. there is a 75% chance that there will be little or no change to UK participation in the EU. View the video here.

Investment Commentary

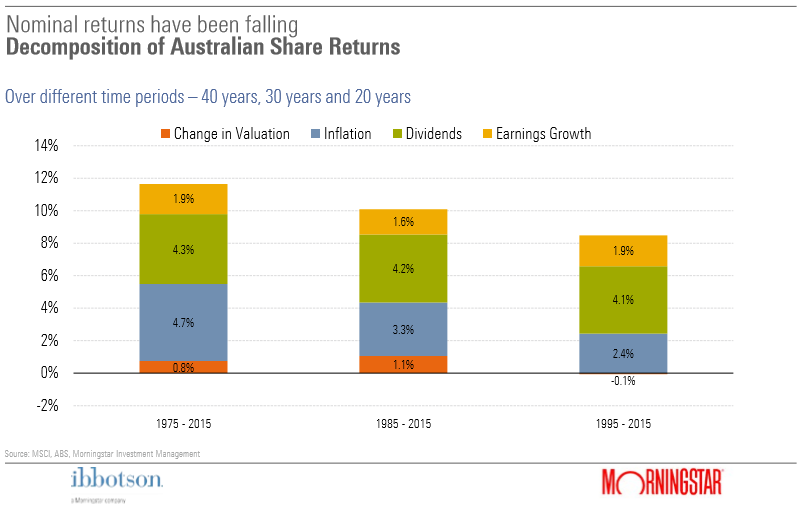

- We are in a low inflation era. The graph below shows dividend and earnings growth remaining steady with reducing inflation shrinking nominal returns.

- With current limits on significant monetary policy easing, as interest rates are so low, there is limited capacity for inflation to increase.

- Yield compression and low investment returns are here to stay for some time.

Asset Class Views

- US markets – expensive

- Aus equities – neutral (but no longer over-priced)

- EU equities – neutral (attractive opportunities are abundant but active management is necessary)

- UK equities – unattractive

- Asian equities - neutral

- Bonds – unattractive (For better yielding fixed interest opportunities it is worth considering syndicated loans. Syndicated loans can achieve higher yields, with some flexibility to put in place terms that can reduce the scale of asset loss during default).

- Cash – Always an effective hedge, but with global risk free rates so low, long term exposures provide little value. Consider holding cash in USD with the expectation that the USD may continue to appreciate relative to the AUD.

Sector Views

Volatility in markets of sees a flight to Utlities (i.e. the infrastructure providers), Consumer Staples and Telcos, which will tend to perform well.

OPEX (operational expenditure) commodities, such as Energy and Materials, often struggle.

3 Stocks to watch

Seek

Macquarie Atlas Roads

ResMed Inc

Regulatory Proposals

Snowgum Financial Services has provided the following policy submissions in the second quarter of 2016

National Disability Insurance Scheme (NDIS) | Costing of the NDIS is probably underestimated. Overlooked have been strategies to reduce the uncertain costs of the NDIS. One key initiative would be encouraging the take up of privately funded insurance. When in place, a privately sourced alternate income stream would reduce the costs of and the community’s reliance on the NDIS. Strategies that motivate self-insurance, similar to those used for private hospital cover. We outlined how this can be achieved here.

ATO self-managed super fund (SMSF) guidance | Under the rules of the SIS Act, SMSF trustees are required to maintain an investment strategy that considers the investment, risk and insurance needs of the fund. The ATO provides guidelines about how this should be undertaken. The ATO, we believe, incorrectly outlines cost savings associated with insurance available via large super funds. It is inaccurate that large group super insurance schemes provide more affordable cover. As these schemes do not fully assess risk (via underwriting), they are exposed to a greater claims risk, resulting in higher premiums. If moderately healthy, individual personal insurance, which can be run through a SMSF, meets trustee requirements and saves considerable premiums.

Please contact us for further information on how to address your insurance in superannuation, or for more details of our submission.