Economic Wrap

Borrowing a euphemism from the sporting world, 2015 so far "has been a game of two halves".

The first quarter of 2015 saw markets perform strongly on the back of cheap money globally and subdued European and US optimism.

As we approach the end of quarter two, European pessimism erupted on fears of a Grexit (Greek exit) and with valuations previously stretched, asset prices retracted.

The prevailing themes in global markets continue to be the medium term availability of cheap money and China's economic transition from a capital intensive economy to a service orientated economy.

In Europe, the real fear of a Greek exit is that it symbolises the failure of the EU movement, providing a catalyst for further EU fracturing. As market participants, we are more concerned with a fracturing EU and less so of a Greece only exiting scenario. As a fracturing EU at this stage seems unlikely, we are hopeful that things settle down with the passing of time.

Closer to home property prices have swelled on sustained lower rates and the AUD remains stubborn to RBA jaw-boning. The Aussie market continues to cautiously watch commodity revisions coming out of China

Investment Opportunities

Investing, by definition, involves taking risk; whether the investor is aware of the risk they are being paid to take on, or not. Our investment decisions focus on being as certain as possible on the risks we are taking and then making sure that we as investors are paid adequately for taking on this risk.

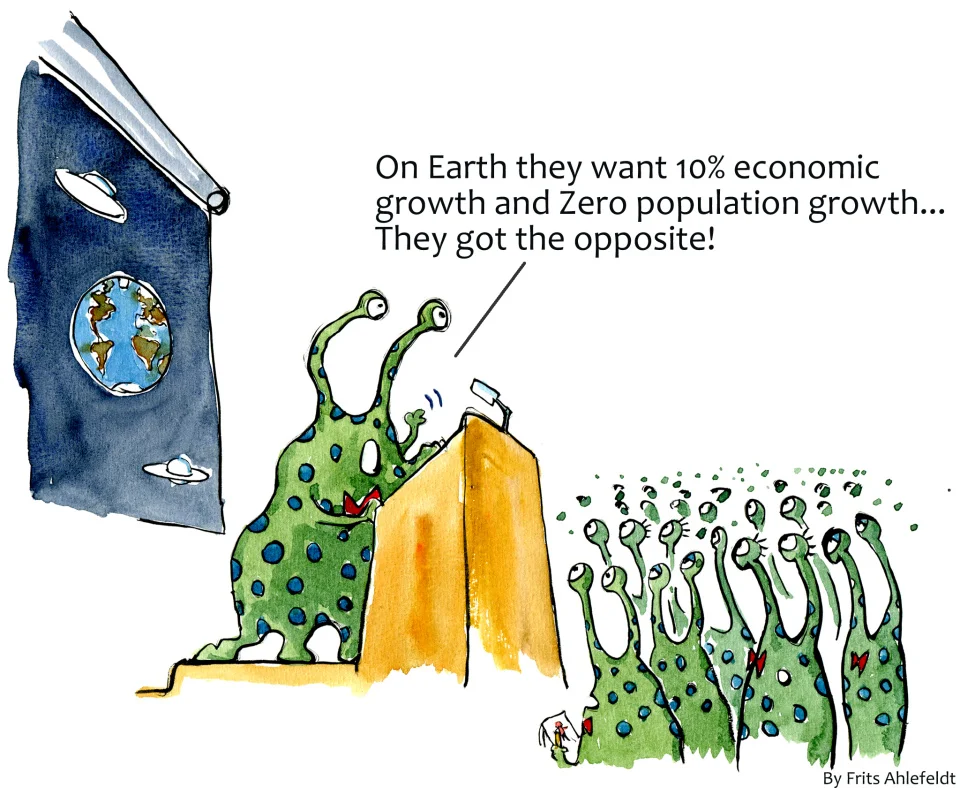

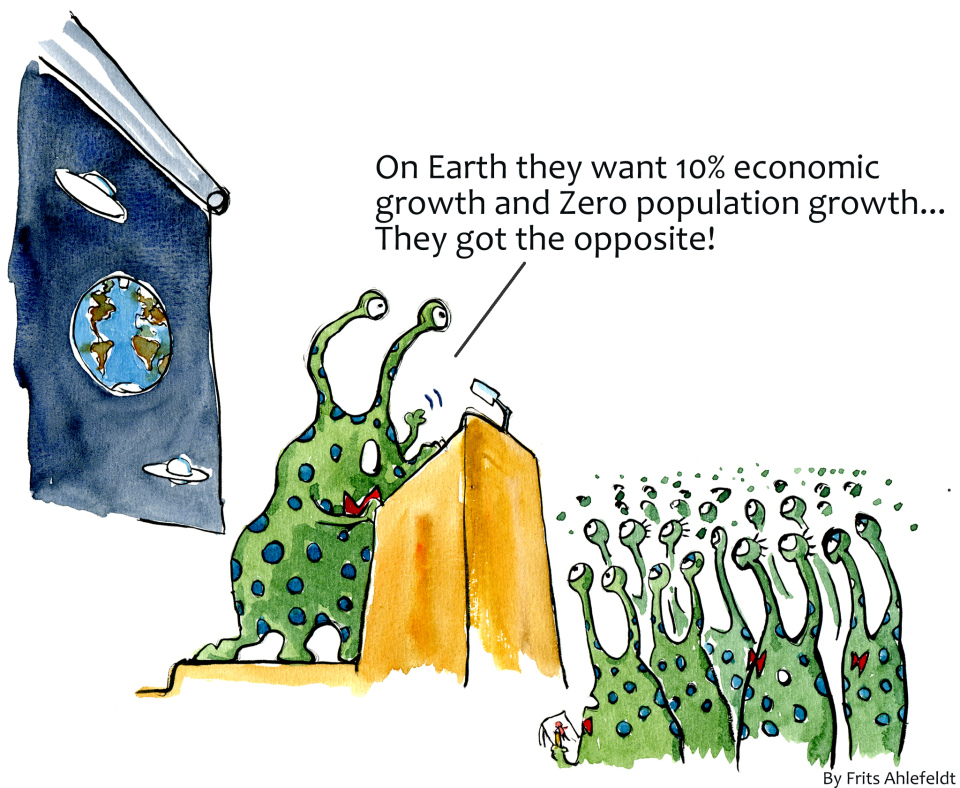

It is this later proposition that is proving challenging as all asset classes appear fully priced. So where does that leave us? We believe there are two key sources of risk for Australian investors:

1. The reduced hard commodity demand resulting from China’s great economic restructuring is a clear and present danger for the Australian economy and our share market.

2. US shares, on any sort of reasonable long term valuation methodology are, at a minimum, “fully valued”.

With these two key risks in mind, there are more attractive places to allocate money to work than a concentrated weighting to the Australian market or a passive exposure to global equities.

The Australian dollar still looks over valued, but obviously less so than when it was at $1.10 to the US dollar. No amount of jaw-boning from RBA head Glen Stevens appears to have been effective at addressing this.

These conditions make un-hedged international investments more favourable. Noting that this is not a “buy anything international” view, especially given the "fully priced" US market.

This has lead our investment hunt to the following areas: Select emerging markets and very selective stock selection within those markets, areas of Europe, more developed Asian economies and as always companies with high quality, predicable cash flows.

For those lower down the investment risk curve we see some value in accessing inflation linked bonds.

How are we pursuing these investment opportunities?

Current market conditions warrant active investment management. During periods of market uncertainty, active investing has much greater scope to manage risk. Active managers have greater flexibility to isolate capital from obvious valuation anomalies. This does not occur in passive investment exposures.

We assess manager competency by partnering with independent research houses as well as overlaying our own active manager preferences. We look for managers that can;

- Demonstrate material divergence from the index they operate within. This is called tracking error. Don't let the word 'error' throw you off, tracking error is a good measure of the conviction of an active managers investment views.

- Have some scope to manage downside volatility. This might mean investment mandates that allow up to 15% of portfolio exposures to take advantage of downside opportunities.

When the above parameters are overlaid with detailed research house reporting, we begin to formulate some preferred investment management partners.

Although passive investment management has proven to be successful during periods of stable economic growth, given current elevated asset prices, sustained market volatility and the possibility we are nearing the end of another business cycle, passive investing is not the preferred investment style at the present time.

For Bond exposures, we access these directly from corporate, semi-gov or government issuers. There is a very deep secondary market for bonds allowing flexible access to opportunities and investor liquidity.

If you are interested in revisiting your investment portfolio construction and/or strategy, do not hesitate to contact us.

News From Snowgum

In the Media

Snowgum Financial Services principal, Matt Vickers, discussed the 'Slow path to professionalism' for the financial planning industry in the June edition of wealth professionals publication Money management. In this article Matt discusses how the financial planning industry and more importantly the consumers of advice, would greatly benefit from industry becoming a self directed profession. He proposes that industry governance be taken up by incumbent professional bodies the FPA and AFA, similar to other professions like dentistry, medicine and law.

To download a copy of this article, click here.

The Development Pipeline

Snowgum Financial Services is currently developing a web based client portal to be rolled out over the next few months. This portal allows clients consolidated access to all their financial data in one place. This development will be advantageous for a variety of reasons;

- It acts as an information hub for families with broad investment exposures capturing; direct shares, bonds, managed funds, ETF's, SMA's, LIC's, direct investment property, artwork investments and cash facilities all within the one consolidated view;

- The burden of responsibility is no longer concentrated to one primary knowledge holder in a family. This provides the family peace of mind that affairs are transparent for family members to administer should the key knowledge holder lose their ability to manage affairs in the future;

- Generate very powerful and timely consolidated tax reporting with reconstruction of historical corporate and tax events for share holdings. This will assist in streamlining accounting administration and potentially lower accounting costs or improve reporting quality and timeliness;

- An institutional service without any institutional product bias;

- This is flexible enough to incorporate investments that are not under advice by a Snowgum adviser, but may still influence investment strategy.

- Being mobile friendly, should you choose, your financial life can be accessed any time in the palm of your hand.

This roll out will be combined with some additional features and information tools as part of Snowgum's next technology deployment.

Client Milestones

Snowgum client Nexba Beverages has successfully rolled out their Ice Tea throughout Coles stores!! This is a tremendous achievement from the young, half-handsome, entrepreneurs who are on the cusp of greatness.

Support our clients next time you're in Coles and pick up some ice tea. We are partial to the Peach flavour at Snowgum, but they are all awesome!!

Our Most Popular Articles

We write regularly about various topics. Being competitive by nature, we like to rate our top performing article based on readership each quarter. Top three performers from left to right.

"Gen Y has their head in the clouds when it comes to saving"

Well and truly taking out the top spot. We introduce Phoebe, a hapless saver and handbag enthusiast and the sort of person we all know or can relate too.

We had a lot of fun writing this and it picked up nearly 5,000 organic views!!

"Investing 101"

This article comes in as a strong second proving that everybody loves a quick information update. Covering off on all the basic of investing, it is a great place for anyone to start.

Learn the basics of investing in under 5 mins!

"The Human Vs Financial Capital Trade-off"

This rounds out this quarters popular articles.

The title is certainly a mouthful but the content is readily digestible and an important read for those who think they don't have any important financial assets.

Any advice contained on this newsletter is of a general nature only and does not take into account your circumstances or needs. You must decide if this information is suitable to your personal situation or seek advice. Prior to investing in any particular product, you should read the Product Disclosure Statement.

Snowgum Financial Services Pty Ltd (ACN 603 703 859 is a Corporate Authorised Representative (Corporate ASIC AR number 001001581 ) of Peter Vickers Insurance Brokers Pty Ltd (Australian Financial Services Licensee (AFSL) No 229302 & Credit Licensee (ACL) No 229302