Financial planning, when done well is about solving problems. Good financial planning focusses on achieving specific personal goals and even helps refine what these goals might be. It then formulates often multiple strategies that can help solve problems and provide a platform to build upon.

Bad financial planning most often occurs from a loss of context in the advice provided. Poor advice will outline strategies that are not clearly related to the problems they solve for the client or how the strategy addresses the clients needs. Downright ugly advice misses the personal context and strategy steps altogether and skips to implementation, focussing on expediting a transaction.

The Good

Good advice solves problems, the value of which extends well beyond financial metrics. When communicated well financial advice helps you;

- Protect loved ones in your life who are dependant on you should you be disabled, or worse, from generating an income;

- Live a worry free retirement, where the income you generate won't be outlived;

- Provides you confidence in making financial decisions and a second knowledge holder to assist your family manage their financial obligations, should you no longer be able to;

- For company directors it can provide an income safety net that upholds your companies social responsibility towards valued employees, without long term financial exposures.

The value in achieving the above objectives is far greater than some technical performance metric or a discussion centred around financial jargon. Advice outcomes address specific goals, objectives and solve problems.

The Bad

Bad advice often results from a lack of understanding of your specific goals, objectives or problems. This advice can leave you with more questions than answers. Although the advice intent might be well meaning, how it relates to your individual goals can often be somewhat confusing. Without your personal context framing a recommendation, receiving a recommendation like any of the below can be meaningless;

- We are recommending that you put in place X amount of insurance cover, owned through your super fund;

- Your investment portfolio remains appropriately weighted to a distribution of asset classes for someone with your risk tolerance;

- We believe you should put in place an income protection policy with a benefit of X dollars;

- We recommend you re-finance your mortgage to a line of credit arrangement.

The difference between good advice and bad advice can sometimes be as simple as poor communication.

The Ugly

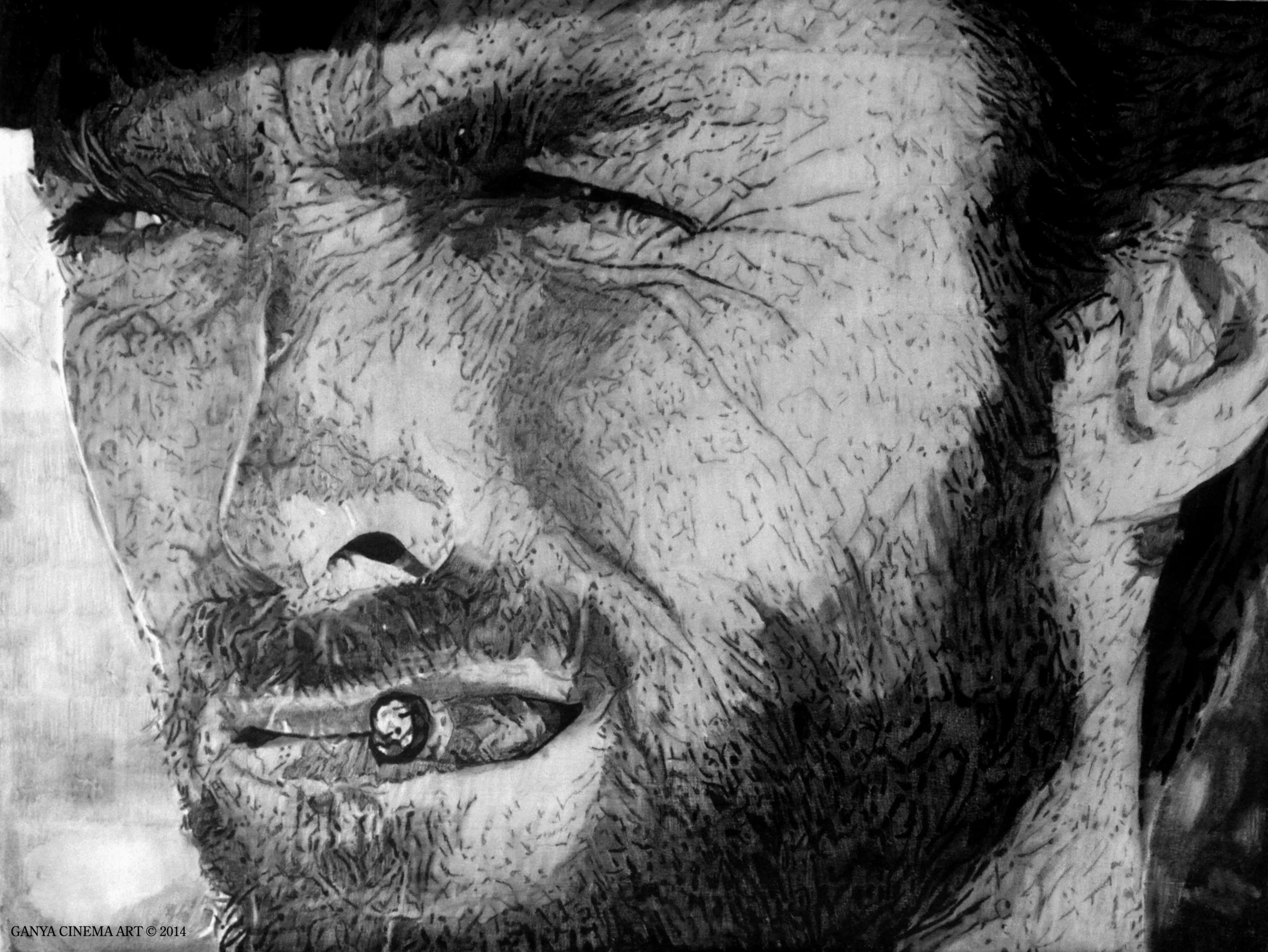

Now you might think ugly advice is easy to spot, like a 'not so subtle' suitor eyeing you from across the bar with their 'lazy eye'. However, in recent years even amongst some of Australia's most prominent and 'ocularly' prodigious institutions, there have been serious 'lapses' in advice quality. Much of this was/is the result of cultural pressures to sell institutional financial products, regardless of the advice recipients needs and personal context.

When advice becomes an avenue for product distribution, where financial products are recommended irrespective of your circumstances, the likelihood of a gulf between the actual outcomes of advice and your objectives increases.

Recent government regulations have put in place a legal obligation on advisers to act in a clients best interest. With the lions share of Australian advisers still working in association to product manufacturers, conflicts of interest remain heavily embedded within the advice industry and there remains significant room for improvement.

What to look out for

Advisers serve their clients needs in all manner of arrangements and there are very good advisers who are enabled to achieve this because of their institutional support. However, if your needs are complicated or require unique/custom guidance, an institutional solution may not always have the flexibility to accommodate your needs.

When seeking advice, you should understand how the licencing arrangements of your adviser influence the advice you are receiving. I.e. Is it a co-incidence that you happen to be invested in your advisers license controlling interests investment or insurance products?

Most importantly, before accepting any advice or implementing your financial strategies, make sure that there is a clear link to you how the advice you receive solves problems and helps you achieve your goals and objectives.