Quarter one economic & investment update

This quarterly update is written by Matt Vickers, principal adviser of Snowgum Financial Services. It provides summary statistics on key economic and market conditions before we dive into all things renewable energy this quarter.

Please feel free to forward this update to clients, colleagues and friends who can in turn subscribe to it here.

Key Stats

- Economic growth sits at 2.4% per annum

- Inflation is slightly up at 1.5%

- Cash rate remains steady at 1.5%

- Unemployment is at 5.9%

- Comments from both Greg Metcalf (ASIC Chairmen) and Philip Lowe (RBA head) indicate a strong concern that the east coast of Australia is in the midst of a property bubble due to inappropriate tax incentives and poor lending standards

- Business investment continues its consistent steady fall… not good for employees or an economy trying to sustain long term growth.

- Without business investment, we won't see sustainable economic growth, wage growth, which drives inflation and

- Without wage growth, rental yields will remain flat seeing new property investors with worse rolling returns than cash in the bank and all the while first home buyers priced out.

Investment Focus

We have, for some time, been mentioning the growing financial argument supporting renewables. The time has come to act on rolling out renewable energy on a grand scale and leave the fossil fuel path behind. If your view on renewable energy was formed ten, five or even two years ago, and you have the perception that they are expensive... think again.

Renewables – The tipping point.

We have all been aware of the growing value of renewables for some time. Decades ago our collective conscious formed the ‘clean but expensive’ view to renewable energy needs decades ago. Although the present political environment and consumer energy prices aren’t helping, we need to change our thinking.

Australia’s fleet of older coal fired power stations is aging. Banks won’t lend to build a coal fired power station and consumers, via their hip pocket, are paying for government policy of stagnation and finger pointing on the transition to renewable energy solutions. More here

The cheat sheet

- The notion that going clean is expensive is not true.

- Wind power is currently the cheapest form of energy production at US2.5c per KWH vs traditonal fossil fuels at around US7.5c per KWH

- Solar power is particularly attractive given Australia’s habit of spending half the year hanging out next to the sun. Solar prices are coming down at lightning speed. It is not cheaper than wind just yet, but it could be by the end of this year and almost certainly will be by 2020.

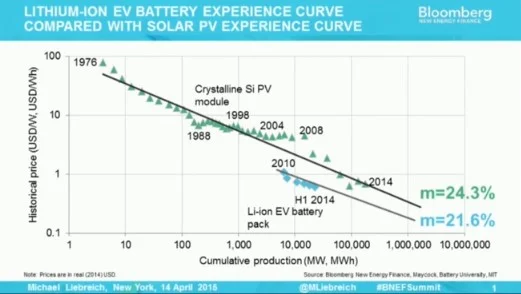

- The velocity of the decline in the 'price performance' of solar is so fast, that when plotted against other costs of energy production, it looks like a child has scrawled on an otherwise low profile graph.

- In 2016, solar power became cheaper than virtually all forms of fossil fuels.

- In the Middle East, the home of oil, solar power is half the price of natural gas or coal generated power. Aqua power, a Saudi group, is producing energy at 2.99c per KWH.

- Solar power has grown 100 fold in the last 13 years, or 40% year on year growth.

- When you make more of something the price drops. So it is with solar power.

- Solar is a technology based source of power and it will continue to become more efficient as the technology improves exponentially, along a steep learning curve. As solar becomes more efficient it attracts more users which attracts more interest and investment which in turn produces more technological innovation which then makes solar even cheaper. An admirable and positive cycle.

- Warren Buffet recently acquired the US’s largest solar provider.

What is hindering the a solar revolution?

- Night and clouds – this however is already beginning to be mitigated with large scale, interconnected and dispersed solar production plants supporting each other. In addition using wind with solar reduces the problem of clouds and nights, and the reliance on wind generation in light wind conditions

- Politics – the federal support for renewable energy is pathetic

- Storage – the final impediment preventing fossil fuels becoming obsolete is power storage, that is both the cost and capacity or energy density of batteries.

Energy Storage

- Pump hydro is mature and proven. This is where excess energy in the grid is directed to a pump that pushes water back up behind a damn wall. When there is a shortfall of energy, this water can be released from damn to generate hydro energy. Water behind a damn wall is essentially stored energy.

- Unfortunately Pump Hydro it expensive, scale inflexible, centralised and has a significant lag in delivery

- Batteries are emerging as the most promising solution

- Batteries can be decentralised and installed quickly, are portable and scaled flexibly.

- But they are still expensive, and provide nowhere near the energy density of liquid fuels.

Batteries are approaching their own tipping point

- In TESLA’s first week their battery packs received US$1b in pre-orders

- Majority of TESLA Powerwall orders were from businesses, manufacturers and utility providers

- Because energy is cheap at night and expensive during the day, many energy intensive businesses are financially better off buying a battery and charging it from the grid at night to supply power during the day

- The demand for batteries from manufacturers and businesses has driven a tremendous amount of investment into the battery market

- There has been a five times reduction in battery cost in the last five years alone

- Battery storage is now below US$190 per KWH

- Batteries are still in the earlier years of their ‘learning curve’, with the cost and performance of batteries improving at a similar exponential rate to the improvements of solar power generation.

Like the cycle of re-investment seen in solar power, improvements in the price and performance of batteries encourages further investment, which creates further productivity improvements, this then leads to further efficiency gains which drives further usage and investment.

The path for battery improvement

Battery possibilities exist beyond Lithium-Ion, with various technology avenues at different stages of maturity;

- Flow batteries which are bigger and heavier than Lithium-Ion, but with 5-10 times the life span

- Supercapacitors with enhanced graphene energy density

- Superconducting magnetic energy storage (SMES) – more here

- Adiabatic CAES – more here

- Hydrogen – more here

Implications of continued improvement in batteries and storage

- The world in 2017 will be deploying more clean energy per year than fossil fuels. The world will never go back (irrespective of populist political resistance)

- Solar power will be the cheapest source of power in the medium and likely long term future

- Declining battery costs make electric vehicles (EV’s) ever more cost effective

- Electric vehicles may become be better value for performance than internal combustion engine (ICE) cars by 2020-2022. More here

The Rise of Electric Vehicles (EVs)

- TESLA received 200,000 - 300,000 orders for the Model 3 on its first day

- TESLA predicts that 500,000 vehicles will be produced per year by 2020

- Electric vehicles have 90% less moving parts than traditional internal combustion engine (ICE) cars

- As battery prices come down, so too does the cost of EVs

- As the cost of EVs comes down, more cars are purchased

- As more EVs are purchased, the learning curve further reduces the price of EVs

- If you are an eager beaver an all things EV, dig into this comprehensive report by Dr Peter Harrop – Report link here (note: it is not free)

- Norway and Netherlands have passed resolutions that will ban the sale of all traditional ICE (emitting cars) from the roads by 2025

- By 2030, based on extrapolating at half the current growth in EV sales, mid/high performance EVs will be more affordable than the cheapest available ICE car… the end of ICE cars and petrol stations (if they don’t evolve).

- Continued advances in EV production will see significant reductions in power storage. When combined with solar improvements this will significantly reduce the cost of energy.

Industry implications

- Water security – half the cost of desalination is energy. Lower energy prices will provide a cost effective global supply of fresh water via desalination.

- With growing use of EV’s, there will be significant pressure on oil prices with an eventual irreversible reduction in demand;

- Even a small 2% increase in supply or reduction in demands creates significant market volatility

- A continued reduction in oil demand will see prices plummet or an all-out oil crash as early as 2030.

2017 may be remembered as the tipping point year where the social conscious accepted that going clean is financially viable.

Kodak invented the digital camera, but ‘dropped the ball’ which eventually sent them bankrupt. In 2016, Australian researchers at the University of NSW set the world record for the maximum energy extraction from a photo-voltaic cell. Yet a total lack of government policy stability and support could see Australia squander this significant growth opportunity, a tremendously stupid missed opportunity for a sunburnt country, rivalling even Kodak’s failure.

Disclaimer

Any advice contained in this update is of a general nature only and does not take into account your circumstances or needs. You must decide if this information is suitable to your personal situation or seek advice. Prior to investing in any particular product, you should read the Product Disclosure Statement.

Snowgum Financial Services Pty Ltd (ACN 603 703 859 is a Corporate Authorised Representative (Corporate ASIC AR number 001001581 ) of Peter Vickers Insurance Brokers Pty Ltd (Australian Financial Services Licensee (AFSL) No 229302 & Credit Licensee (ACL) No 229302 ǀ ABN 68 074 294 081).