This Quarterly update is written by Matt Vickers, principal adviser of Snowgum Financial Services. It provides a high level overview of economic and market conditions before taking at detailed look at the demise of inflation. We finish off with our thinking on the changing fates of passive investing.

Please feel free to forward this update to clients, colleagues and friends who can in turn subscribe to it.

Key Stats

GDP growth is at 1.8% for the year, as at October 4 (RBA)

Cash rate finished up at 1.5% (RBA)

Inflation dropped from 2.1% to 1.9%. Any chance of cash rate rises in Australia just became even less likely (RBA)

Coincidently, wage growth currently matches inflation at 1.9% (RBA)

Unemployment bounced back up to 5.6% from its unexpected low of 5.5% last quarter (RBA)

Inflation is an endangered species

Money is still what it used to be...

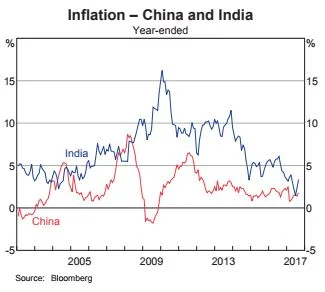

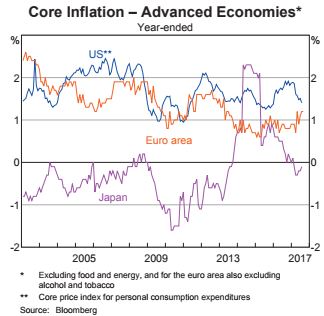

Aussie inflation dropped from 2.1% to 1.9% this quarter, keeping firmly in its medium term holding pattern at the bottom end of the RBA’s target range (graph 1). The developed world also struggled to stoke their own inflation fires (graph 2) and even developing countries are falling victim to the new normal of lower inflation (graphs 3 & 4).

Can inflation mount a Robert Downey Jr style comeback?... we think not.

In Australia, the recent drop in inflation (although just a blip in the long-term) is particularly interesting in the context of rising energy costs and a housing price boom. Both on the surface have been inflationary without even moving the needle. We believe each of these recent spikes has the potential to become heavily deflationary in the long-term.

Australia’s Housing sector boom stems from a combination of a low interest debt binge, foreign investment and low housing supply in key markets. Macro-prudential intervention has been successful in tightening lending standards and increasing debt servicing costs. Australia is dealing with a huge debt hangover hampering future consumer spending and any further substantial asset price appreciation in the medium term. Property owners might be wealthier on paper, but with limited wage growth and higher expected debt servicing costs, they don’t feel wealthier and aren’t loosening the purse strings.

Higher energy prices are squeezing businesses and households further still. This current energy market turbulence is part of the very rocky long-term transition to cheaper and democratised renewable energy. The marginal cost of producing renewable energy is virtually zero. The significant obstacle in fully making this shift is energy storage and transmission. 58% of recent energy price hikes stem from increased transmission costs (maintaining the poles and wires network).

Not even politicians, emboldened by their best budgie smugglers, can stop the steady rising tide of scientific discovery, innovation and the disruptive effect of market forces driving commercial outcomes. More competitive storage options will come online decentralising renewable energy, resulting in the proliferation of solar cells on roofs, community wind, solar and storage stations, providing cheap energy to the masses. Battery technology is in a continuous evolution with Lithium Ion batteries still improving and more commercially viable sodium ion batteries attaining key milestones. More here

The long-term impact will be far cheaper access to energy than at any time in history. This will have massive global deflationary effects and be particularly destabilising for old world energy rich countries like Russia and much of those in the Middle East.

3-D printing may seem like an odd inclusion in the demise of inflation, but the fledgling industry has the long term potential to digitise physical goods in the same way we have music and video. A physical good when coded, can be purchased online for pennies and dimes. The code is the sent to your families 3-D printer. Once you cut out distribution, retailing, inventory, packaging, centralised production and labour costs – the future looks very deflationary.

Finally, in the short to medium term, policy makers are making more noise about attempts to normalise cash rates. There just isn’t scope to do this in Australia, but the clear global intent coupled with record low cash rates means even the slightest up-tick in inflation will see the shackles lifted on policy makers to lift underlying cash rates. This means even slight inflationary pressures will quickly be met with a tightening monetary policy response.

Passive investing on the nose

What is passive investing

Passive investing is an investment style that aims to replicate a benchmark investment return. I.e. Should the S&P 500 index go up 10%, your passively invested portfolio tracking this index also goes up 10%.

One of the great peculiarities of the investment management industry is that active investing, where one is paid to outperform a benchmark, is a zero-sum game. That is, for every investment professional outperforming the benchmark index, there must by an equal amount of under-performance given that the benchmark index return is an average, and over 95% of trading volumes are professional active managers.

Once professional investment fees are accounted for, active management overwhelmingly underperforms.

Nine and half years ago Warren Buffet made a ten-year bet with hedge fund managers that the S&P 500 index would outperform their funds (after fees) over this time frame. The wager was one million dollars. Only one brave manager stepped up to the plate. They have been overwhelmingly beaten by the index, with the wager already settled such is the margin of loss of the active manager. More info here.

The changing winds of passive investing

Having heard us chastise the zero-sum game of active investing; What could we possibly say that undermines passive investing efficacy?

We believe only a structural change in how markets are functioning would impact the status quo of passive investor success. We think such a change is underway, in some markets. Consider:

An index contains many companies. A passive investor is exposed to every company in the index. Between the years 1900-2000, the average lifespan of a company listed on the S&P500 was 64 years. A passive investor had very little exposure to failing businesses. Since the year 2000, the average lifespan of a listed business is now only 15 years. Industries and business are being disrupted faster than ever and the passive investor is invested in every single failing business.

What about the good businesses? Fortunately, the passive investor gets exposure to all these terrific disruptive businesses. Unfortunately, the passive investor buys in late and high. Like the dot.com boom before it, some businesses trade at astronomic valuations. A passive investor chases high after high as they need to hold the market weighted cap of the listed business not its intrinsic value.

We still think there is a place for passive management and are grateful that it has forced the hand of active managers to become more price competitive. However, we think passive investing in mature markets, those full of businesses ripe to be disrupted, gears up and investors downside risk. It is often easier to avoid a losing company than pick the winners.

Disclaimer

Any advice contained in this update is of a general nature only and does not take into account your circumstances or needs. You must decide if this information is suitable to your personal situation or seek advice. Prior to investing in any particular product, you should read the Product Disclosure Statement.

Snowgum Financial Services Pty Ltd (ACN 603 703 859 is a Corporate Authorised Representative (Corporate ASIC AR number 001001581 ) of Peter Vickers Insurance Brokers Pty Ltd (Australian Financial Services Licensee (AFSL) No 229302 & Credit Licensee (ACL) No 229302 ǀ ABN 68 074 294 081).